Retired Canadians often feel pressured into selling their home and downsizing. Family members, friends, neighbours and realtors may be keen to convince you that this is the answer to all of your financial worries. The idea is to cash in on your home’s equity while moving to a more manageable—and cheaper—home.

However, a new survey carried out by Ipsos on behalf of HomeEquity Bank has revealed that downsizing is not the financial solution to retirement that many believe it to be.

Many Canadians are unaware of the true costs of downsizing

The survey, which featured almost 2,000 Canadians aged 55 and over, discovered that 41% of homeowners admit that they don’t actually know how much it would cost to downsize.

Furthermore, 39% of homeowners are skeptical that downsizing will actually save them any money. This is not too surprising, considering 31% of homeowners said that downsizing costs were more than they expected.

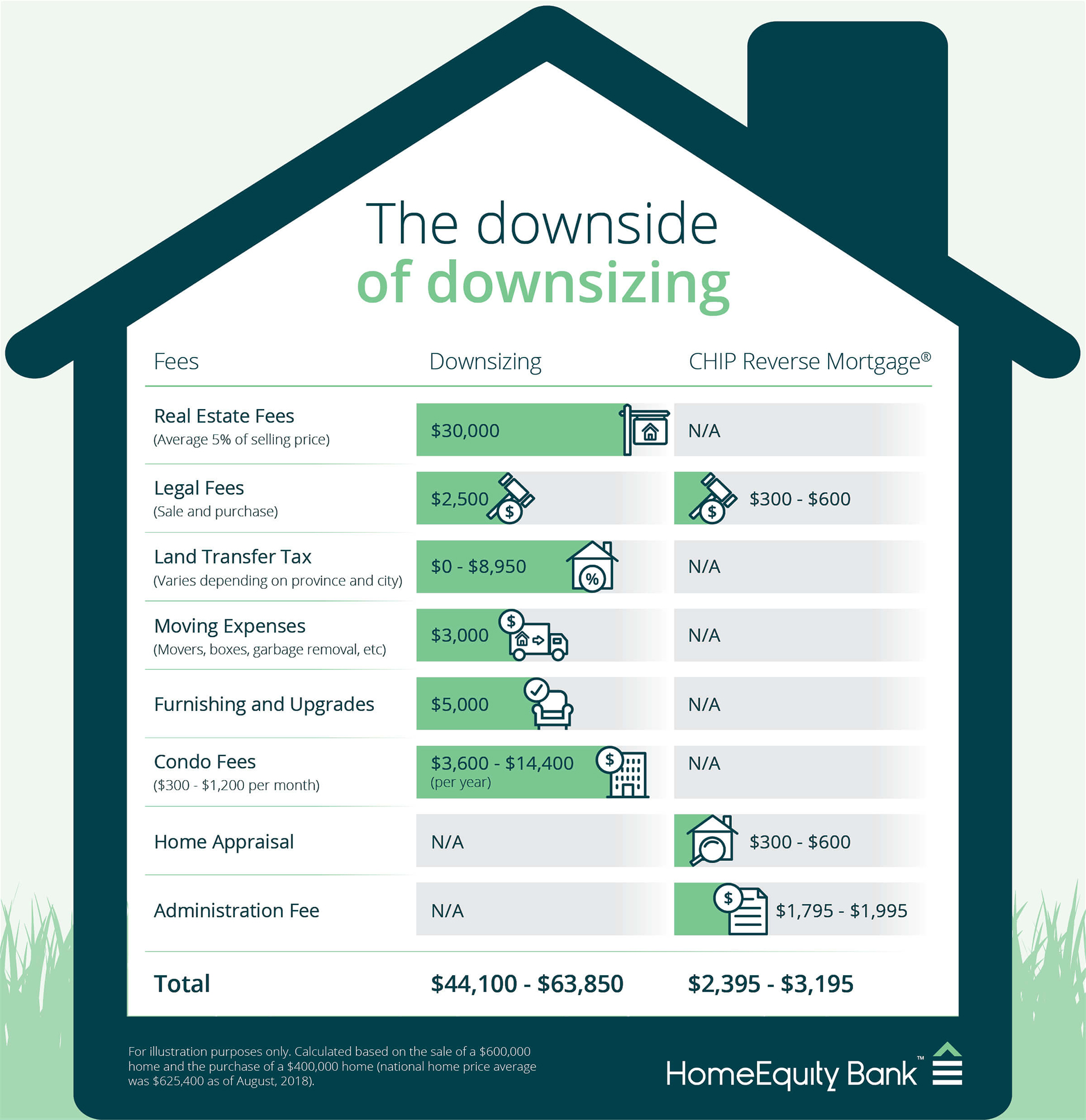

Like these Canadians, you might not be aware of all of the expenses involved. To help illustrate how much downsizing could actually cost you, we’ve created a snapshot of a typical downsizing situation, breaking down all of the expenses involved.

Downsizing: a cost analysis

For this analysis, we used an example of selling a $600,000 home and buying a smaller house or condo for $400,000. In theory, this would free up $200,000 in equity while moving you into a smaller home. This is the kind of income boost you would need to have a meaningful impact on your retirement finances. But how much of that chunk will you actually get to keep to boost your nest-egg?

Click here to expand

Click here to expand

As you can see, downsizing could cost you $44,100 – $63,850.

If you live in a big city like Toronto, your $200,000 of equity could shrink to just $136,150, after downsizing*. This is a huge chunk of your money that disappears into thin air after you downsize. But this isn’t the only reason many retirees are refusing to go this route.

The emotional cost of downsizing

To make downsizing financially worthwhile, you need to move into a new home that costs substantially less than your current one.

If you live in a big city, this could require moving hundreds of kilometres away. According to the Ipsos research results, of those people who have downsized, roughly half moved to a new town.

People who regretted downsizing said the key reasons were missing their old neighbourhood, family and friends. It can certainly be difficult moving away from children and grandchildren, especially if you’re retired and have more time to spend with them. Others missed their old home and the memories they had created there.

It’s not surprising, then, that 48% of homeowners don’t plan on downsizing. However, at the same time, 31% of retirees say they need to cash in on their home’s equity to live comfortably in retirement. So what’s the alternative?

Keep more of your equity and stay in your home

A reverse mortgage can help you to access up to 55% of the value of your home. You don’t have to move hours away from your kids and grandchildren and you get to stay in the home you love.

You won’t lose up to $63,850 of your equity in downsizing expenses. It only costs between $2,395 – $3,195 to get a reverse mortgage—this includes legal costs, a home appraisal and administration fees.

With no regular mortgage payments to make, a reverse mortgage is becoming much more popular as an alternative to downsizing.

Call us at 1-866-522-2447 to find out how you can save on the stress and expense of downsizing and live retirement your way.

* This is based on $200,000 of equity minus $63,850 (the highest amount of downsizing cost) equals $136,150.