Know all about the grants and programs available for Canadian homeowners

Although most Canadians prefer to stay in their own homes post-retirement (93% according to a recent IPSOS study), many feel pressured to consider other options due to lack of sufficient funds or for medical reasons. Whether it is the increased life expectancy, the ever-inflating costs of living, or the lack of proper financial planning, many Canadians find it difficult to lead a comfortable life with their retirement savings alone.

In a report on Pension Reform, the Canadian Association for Retired Persons, CARP suggests:

- Two-thirds of the Canadian workforce does not have a workplace pension.

- Private savings options, such as Registered Retirement Savings Plans (RRSPs) do not make up for the shortfall in retirement savings.

However, did you know that the Canadian government offers over 100 different types of grants, rebates and tax credits across provinces, which are meant to help Canadians retain their homeownership or tenancy? Every Canadian province runs its own incentives and programs to help Canadians:

- Save money

- Be self-reliant

- Enjoy the improved quality of life

From grants for home repairs and renovations to property tax credits, write-offs and special needs assistance, Canadian provincial governments are addressing various aspects of Canadians 55+ living at home.

The benefits of the Canadian government grants to help Canadians age in place

Retaining independence is important, especially as we age. Many people find it more comfortable to remain in familiar surroundings even though issues such as deteriorating health and low income continue to create difficulties in day-to-day living. Although family, friends, neighbours and local community programs may help you in some way, it is understandable that you want to be as self-reliant as possible. This is where the government grants for older Canadians come in. No matter what program you choose, all the federal and provincial benefits enable retired Canadians to enjoy a safe, cost-efficient and well-maintained home.

For example, Service Canada’s Home Adaptations For Independence (HAFI) Program, as well as Residential Rehabilitation Assistance Program (RRAP) offer home repairs-related financial assistance to low-income Canadians. Both programs support the home modifications or repairs for people with diminished physical abilities:

- HAFI: is applicable in British Columbia for minor home adaptations, such as the installation of handrails, bathtub grab bars, chair lifts, etc. enabling independent living.

- RRAP: is applicable to all First Nations or individual First Nation members for major repairs to bring the house up to minimum health and safety standards, including structural repairs, plumbing, heating, electrical, fire safety and more.

While every province offers services and benefits supporting a home living for older Canadians, the specifics or nature of the grants may vary. For example, in the Northwest Territories, the government helps you stay warm by subsidizing a substantial portion of your heating bills through the Home Heating Subsidy. If you’re living in Nova Scotia, you have the Home Warming Low-Income Program, through which you can get a free energy assessment and necessary upgrades at no extra cost to you.

Government grants and programs available for older Canadians

The primary aim of the government grants and assistance programs is to enable Canadians, like you, to live independently, safely and comfortably in your home.

Are you eligible for these programs?

- Age: While most provinces define eligibility as someone who is 65 years or older, a few provinces have a lower threshold of 55 years. You must turn that age in the year of taxation, in order to be eligible to apply for any of the programs.

- Income: Your individual or family’s combined annual income may be taken into account to establish your eligibility for the definition of ‘low-income’ in your province.

Do check the specific qualifying criteria for each program on your provincial website. If you are a Veteran or a First Nations’ member, some additional incentives may also be applicable.

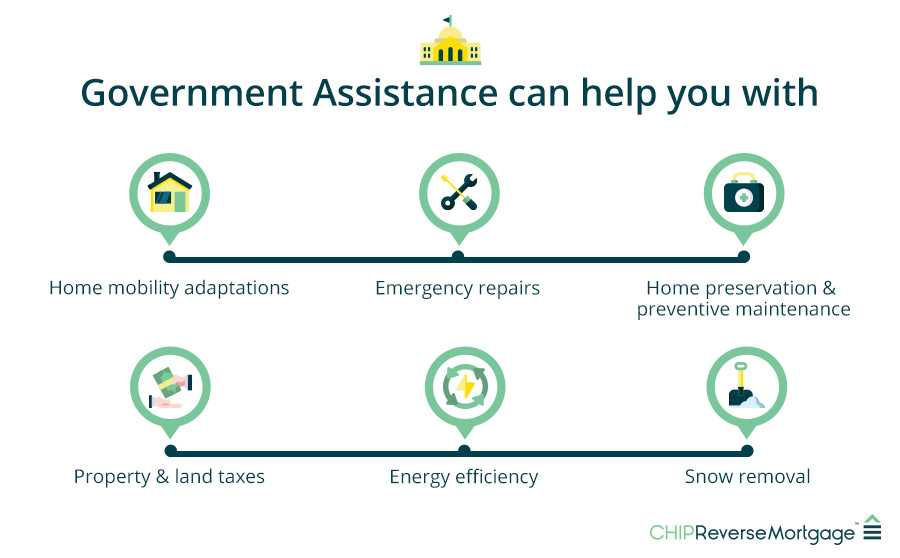

What Types of grants support Canadians living at home?

The grants that support Canadians aging in place contribute to the safety, accessibility and cost efficiency of your home. However, they are not applicable to cosmetic projects undertaken to increase the value or look of your home. Here are some of the home living needs that the various programs address.

- Home adaptations: If you wish to remain in your home, but qualify as low-income and cannot afford the repairs or modifications required to manage age-related challenges, various provincial initiatives offer government grants for home improvements to ensure safe occupancy. Most programs require you to stay in the home for a fixed minimum duration if you use the grant. For example:

- Nova Scotia’s Home Adaptations for Independence initiative mandates a minimum stay of 6 months for the grant beneficiaries. You can get a forgivable loan of up to $3,500.

- In Alberta, the SHARP allows you a maximum loan of up to $40,000.

- Newfoundland & Labrador’s Home Modification Program (HMP) provides funding in the form of forgivable grants of up to $7,500 and repayable loans of up to $13,000.

- In Ontario, the Ontario Renovates Program provides funding to low-income Canadians, as well as persons with disabilities to help them carry out necessary repairs and accessibility modifications that support independent living.

-

Emergencies: The provincial emergency repair programs provide assistance for sudden or unexpected home repairs related to the heating systems, chimneys, doors and windows, vents, roofs, walls, floors, ceilings, plumbing, electrical, or any other structural problems. Nova Scotia’s Emergency Repair Program that offers up to $7,000 to eligible applicants is one such government grant.

Some provinces offer emergency financial assistance, especially to meet utilities-related expenses.

- If you are a low-income resident of Toronto, the City of Toronto Emergency Energy Fund offers financial aid for water, gas or oil arrears, through which you can avoid disconnection of services.

- Ontario’s Low-Income Energy Assistance Program (LEAP) gives its eligible residents waivers or refunds on the security deposits. LEAP also extends the grace period before disconnection of services and provides financial assistance of up to $600 for utility bills arrears.

- Home preservation and preventive maintenance: In addition to the emergency repair services and home adaptation programs, some provincial programs address the preventive maintenance and preservation needs of your home. The objective continues to be the same; to make your home safe, accessible, and affordable.

- In Nova Scotia, the Home Ownership Preservation program provides financial assistance to homeowners to carry out major repairs or renovations that bring their home up to the required health and safety standards. It requires the beneficiaries to continue living in the same home for at least 10 years post the repairs.

- Property or land taxes: Provincial programs offer credits, deferrals or complete waivers of various taxes that you owe the government if you qualify on the stated age and income parameters. A few of the grants include:

- Quebec’s Independent Living Tax Credit gives you a 20% refundable tax credit for the expenses you may incur on a purchase, lease, or installation of equipment or fixtures at your residence. If you have owned the home for over 15 years, you can avail of the Grant to Offset a Municipal Tax Increase.

- If you are a Saskatchewan resident, you may be able to defer all or part of your property and library taxes for the year through the Property Tax Deferral Program.

- Similar programs are available in Alberta, British Columbia, Ontario, New Brunswick and Northwest Territories.

- New Brunswick’s Home Renovation Tax Credit is a refundable personal income tax credit that you can use for home improvement expenses related to safety or accessibility.

- Secondary suite (granny suite): With assistance from federal, provincial and municipal programs, it is becoming increasingly easier for homeowners to build secondary suites, (also known as granny suites) as an additional source of income. Whether this extension is adjacent to your primary property or built as a basement, it should have its own entrance, bathroom and kitchen for it to qualify as an independent secondary suite. This type of construction is not only helping older Canadians to become self-sufficient and live independently, but it is also addressing the housing needs of the rapidly growing Canadian population.

- In Ontario alone, several municipalities offer incentives for building and repairs of secondary suites. This includes the Niagara Secondary Suites Program, Region of Peel’s Peel Renovates program, the Town of Blue Mountain’s Secondary Suites Grant Program, Kingston’s Secondary Suite Affordable Housing Grant Program, and many more.

- In Alberta, the city of Edmonton offers the Secondary and Garden Suites Grant, where qualifying homeowners can receive up to $20,000 with a 5-year operating agreement with the City.

- Manitoba’s Secondary Suites Program provides 50% of the construction costs up to a maximum of $35,000 in the form of a forgivable loan.

- City of Saskatoon’s Secondary Suites and Boarders offers a 25% rebate on the permit for an existing suite, or a 100% rebate for building and plumbing permits for a new suite.

- Energy efficiency: Several Canadian provinces offer a free home energy audit, energy efficiency advice, as well as the installation of energy efficient products at no cost to you. The type of benefits and subsidies vary from one province to another.

- Manitoba’s Affordable Energy Program provides a free energy efficiency inspection, free insulation, a significantly subsidized natural gas furnace, as well as a rebate of $3,000 for the purchase of a high-efficiency natural gas boiler.

- In British Columbia’s Energy Conservation Assistance Program (ECAP), you may qualify for free installation of water saving devices, hi-efficiency refrigerators, insulation, draft-proofing and more.

- In Newfoundland & Labrador, the Home Energy Savings Program (HESP) helps low-income homeowners to make their homes more affordable by increasing their energy efficiency and reducing their greenhouse gas emissions. If eligible, you can apply for a grant of up to $5,000 per unit.

- Snow assist: Several Canadians 55+ with low-incomes and diminished physical abilities continue to stay by themselves in single dwelling Canadian homes. In addition to the community outreach initiatives, many of the provincial government programs offer assistance to clear the snow from the steps, ramps, sidewalks and driveways of eligible homeowners. Here are a few examples:

- Halifax’s Snow Removal Program offers direct assistance to clear snow.

- Ottawa’s Snow Go Assist Program provides financial assistance of $250 to $450, enabling eligible Canadians to hire contractors for snow removal.

- In Kamloops, you have the Snow Angels program, which pairs neighbourhood-based volunteers with residents who need snow removal assistance.

Other benefits and programs for older Canadians

The federal government is committed to supporting Canadians through a number of initiatives and benefits that promote financial self-reliance and independent living at home.

- Service Canada offers public pension plans aimed at income security, including Old Age Security (OAS), Guaranteed Income Supplement (GIS), and Canadian Pension Plan (CPP).

- Veterans Affairs Canada extends a wide range of facilities and benefits to eligible Veterans and their families and caregivers.

You can view all the grants and benefits created for older Canadians on the Government of Canada’s Programs and Services webpage. For specific information on a grant, rebate, credit or deferral that applies to you, check out Benefits Finder, a useful tool developed by the Canadian government.

Reshaping the future of Canadians aging in place

No matter where you live in Canada, the federal, provincial and municipal government’s assistance programs and grants are reshaping the future of Canadians living at home. With the available grants for home repairs and home improvement, you could:

- Repair and maintain your home as per defined health and safety norms.

- Adapt your home to your mobility and assistance needs.

- Renovate your home and add a secondary suite to boost your financial independence.

If you are a Canadian 55+, or if you have an older family member who has chosen to stay at their residence independently, take advantage of the numerous programs that enable Canadians to age in place.

- Be aware of the federal benefits and services, as well as those in your specific province.

- Fill out the application forms; download them from the program’s website, or pick them up from the relevant service organization’s office.

- Submit your application along with the necessary supporting documents required to validate your age, health or income.

Whether you qualify for some or none of the grants listed above, there is another option that will allow you to age in place.

A reverse mortgage is a great solution for Canadians 55 plus who are house rich and cash poor. Many retirees have found that they have not saved enough to live the retirement they want and may be struggling to make ends meet, yet they are living in a property that has the potential to help pay them back. A reverse mortgage can help Canadian homeowners live a better retirement on their own terms.

What can you use a reverse mortgage for?

Reverse mortgage customers can choose to use their reverse mortgage funds for anything they please. However, here are some of the most common use of funds:

- Home renovations

- Living expenses

- Pay off debt/debt consolidation

- Income supplement

- Health care or medical expenses

- Gifting a family member/early inheritance

To find out how much tax-free cash you could qualify for with a reverse mortgage, call us now at 1-866-522-2447.

The Reverse Mortgage Facts You Need to Know!

Read about the pros and cons of a reverse mortgage to see if it is right for you.